TYPES OF FEES:

After registration, business entities are required to pay the following fees:

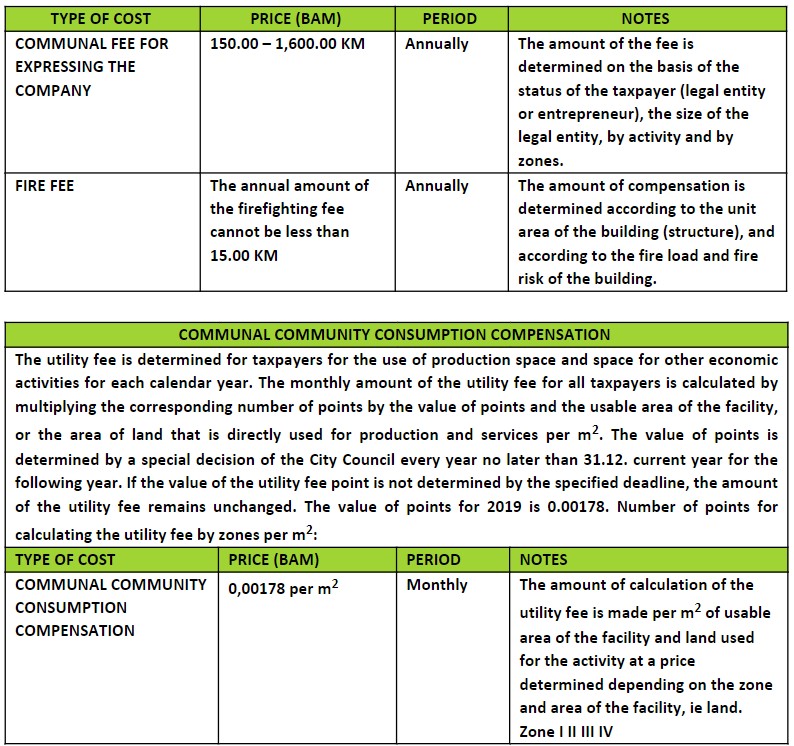

- A tax on a prominent company or an inscription indicating a certain legal or natural person for performing a certain activity or profession;

- Firefighting fee;

- Fee for the use of construction land;

Communal compensation for joint consumption.

LICENSING COSTS:

- Urban consent

- Administrative fee 10.00 KM – 200.00 KM;

- Copy of the cadastral plan with the indication of the user of the subject parcel 11.00 KM + 4.00 KM for each subsequent parcel;

- Conceptual design of the building 3.00 KM – 5.00 KM per m2;Request for prior electricity consent for the location of the facility 35.10 KM;

- Request for electricity consent for the location of the facility 58.10 KM;

- Building permit

- Excerpt from the land registry office 10.00 KM;

- Identification of the plot 5.00 KM, Development of the main project 15.00 KM per m2;

- Audit of the main project 5 % of the investment; > Administrative fee 10.00 KM – 80.00 KM;

- Fee for arranging construction land 10.00 KM / m2 to 40.00 KM / m2 depending on the equipment of the infrastructure;

- Fee for benefits for production space 20.00 KM / m2, for other business premises depending on the zone 40.00 KM / m2 to 60.00 KM / m2;

- Use permit (deadline for resolving a complete application is 30 days)

- Administrative fee 10.00 KM;

- Technical acceptance 350.00 KM - 2,500.00 KM;

- Payment of the object

- Payment of a residential building 185.00 KM;

- Payment of business facility 350.00 KM;

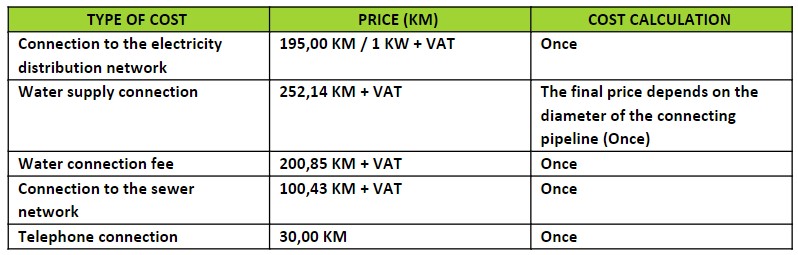

Connection prices